A tech startup’s guide to ESG (Part I)

- Posted by Henry Umunnakwe

- On October 10, 2022

- ESG, Guide, Startups, Sustainability

A start-up is about having a new idea, building a company from scratch and scaling it at quick speed. Focus is around the problem it solves, the product, the team executing, and funding, helping it come to life and thrive faster.

Besides the above, today’s business world has an increasingly broad context. From early-stage start-ups to listed corporations, each company operates within a highly interconnected setting that includes increasingly important stakeholders such as sustainability, the environment and society. With the world’s climate crisis already at our front door, governments, private investors, consumers and even vendor partners increasingly care about the concept of sustainability.

For startups and scaleups with any presence in Europe, caring about environmental, social and governance (ESG) issues is no longer a nice-to-have — it’s a must-have and no company can afford to ignore building sustainability considerations at the heart of its business model. Whatever industry, whatever product or service is sold, operating in a sustainable framework will help it attract customers, partners, employees, public support and future investment.

What is ESG?

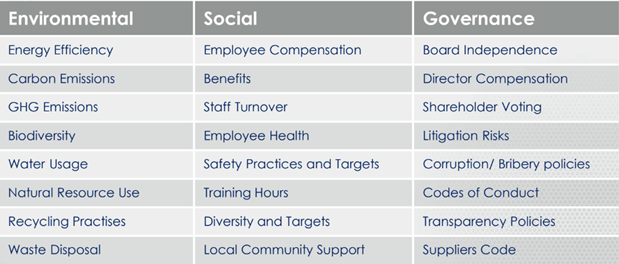

Environmental, social, and governance (ESG) criteria are a set of standards for a company’s operations. Broken into three categories, ESG encompasses:

Environmental: How does the company perform as a steward of nature?

Social: How does the company manage relationships with employees, suppliers, customers, and the communities where it operates?

Governance: How does the company run, including dealing with a company’s leadership, executive pay, audits, internal controls, and shareholder rights?

Why ESG for startups?

Investors already recognize that organizations with strong responses to sustainability issues can perform better than their peer companies and better endure challenging market situations. The number of investors working to integrate environmental, social and governance-related insights into traditional investment approaches is increasing.

Apart from the fact that there will soon be a legally binding requirement for some startups to disclose non-financial information, it also provides an opportunity to highlight the company’s active management of sustainability issues, the operational value added and the impact achieved by its activities.

As reported by Worldfavor “In 2021, The European Commission issued a proposal for a Corporate Sustainability Reporting Directive (CSRD) to revise, expand and strengthen the current sustainability reporting framework of the Non-Financial Reporting Directive (NFRD).

The new CSRD directive will significantly extend the scope of companies subject to the reporting requirements to the following:

– All large companies regardless of capital market orientation with 1) more than 250 employees, and 2) more than 40 million EUR in net turnover, or, 20 million EUR in assets.

– All capital-market SMEs, except for micro-enterprises, starting from 2026. According to the EU, companies qualify as small if they exceed one of these two thresholds: 1) more than 10 employees, 2) more than 700 00 EUR in net turnover, and 3) 350 000 EUR in assets.

This indeed means that startups need to be addressing this right now! Instead of seeing this as yet another limitation, this is in fact an opportunity for startups. Designing tools and policies early on as you are building your company gives you the chance to do it purposefully – this is bound to save time, energy and lead to better long term results.

How can ESG integration create value?

Let’s take a look at how ESG factors integration can create value for a tech startup.

1. It helps when recruiting and retaining employees.

A more meaningful startup has a greater ability to attract and retain employees. In fact, meaningfulness, defined as the feeling that one’s job contributes to society as a whole, was identified as one of the most important employee engagement driver.

2. It reduces risk.

Startups by using ESG criteria vastly decreases unnecessary risks. The extra filter assesses companies according to their corporate governance, working practices, environmental risks and social impact.

3. It lowers costs.

Using production methods that cut waste and encourage reuse results in lower production costs. Being environmentally and financially conscious are two sides of the same coin.

4. It attracts new funding.

Venture capital funds and their limited partners increasingly will demand that their assets be responsible. The green finance market will continue to grow at a high rate, which will push more investment into areas such as renewable energy, waste management, biodiversity and carbon reduction. In 2020, sustainable investment assets grew to $35.3 trillion globally.

In Part II, we’ll be looking at how to get started on your ESG mapping as a startup, some online tools to help you measure and certifications and standards available.

Find Part II here!