A Startup’s Guide to Fundraising (Part 3)

- Posted by Henry Umunnakwe

- On June 6, 2022

- No tags found

In this Part 3, we will deep-dive selectively into the second step – “Approach & Pitching” of the 4-step process and help you understand how VCs assess the various components and metrics of a startup.

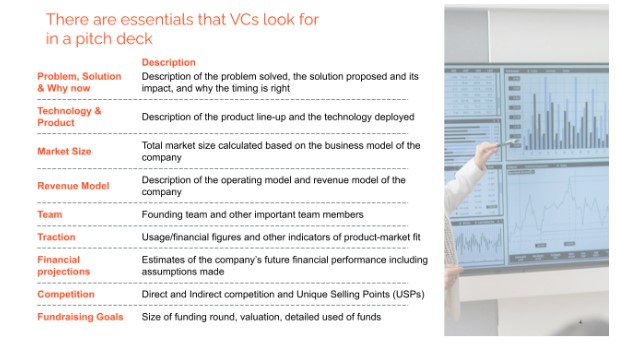

Pitch deck content

A pitch deck is an essential fundraising tool, whether you’re looking to raise $100,000 or $100,000,000. Every startup needs a great pitch deck that talks about its mission, business plan and company overview in order to get investors on board. Below, you will find the essentials that VCs look for in a pitch deck.

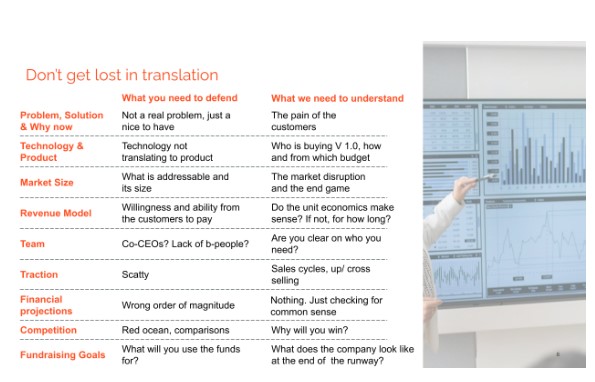

Now that we’ve reviewed what parts to include in your startup pitch deck, we will dive further into what you need to defend and what we need to understand. Often founders and VCs dont speak the same language, it is hence important for founders to understand what the VC is looking to understand from each part of the pitch.

Problem

VCs invest in painkillers, not vitamins. Your product should be essential for your users to perform their daily tasks or enjoy their everyday life.

Technology & Product

Startups often struggle to translate product features that efficiently leverage underlying technologies into client benefits. It’s important to explain how you transform technology into a product that can scale effectively and what benefit (reduced cost, increased efficiency a.o.) the client has from buying it.

Market Size

The market size can make or break the appeal of a deal. First of all, market size should be calculated based on the company’s revenue model to provide an accurate perspective (i.e., if you charge X $/user for your product, the market size should be calculated using that X times an estimate of the total potential users). The most attractive markets are large (> $1b), (relatively) new, and growing in size and interest.

Revenue Model

A startup’s revenue model should be sustainable and scalable, price points should also be reasonable for customers and to the point that its realistic, verified with the target market. According to your revenue model and pricing strategy, VCs expect to see a clear path to enhanced monetisation and profitability. Unit economics should make sense from beginning to end – sacrificing profitability to scale was a doctrine for B2C offerings in the past but is hard to justify in these market conditions.

Team

The team is the most crucial aspect of early-stage companies; it should be able to demonstrate relevant experience and most importantly the ability to work together. Investors also look for complementarity and accountability, which typically means having both technical- and business-oriented founders.

Traction

Another area that becomes increasingly relevant after the Seed stage is traction. Traction can be demonstrated using various metrics, but preferably through sales growth and strong user engagement. Founders should be able to discuss comfortably their sales approach, sales cycle, and other related aspects.

Financial Projections

Financial projections rarely completely materialize, they are however indicative of a team’s ability to put their business into wider context, as well as their ambition. Too low or too slow make a company unattractive, but too high can be seen as frothy and unrealistic. At the early stage, VCs want to make sure that founders are using common sense and understand order of magnitude.

Competition

All companies have competitors, either direct or indirect. Founders must demonstrate their in-depth knowledge of the competitive landscape and the differentiators that can help them win against the competition. We often hear “we have no competitors” – think how your clients are solving the problem today, the incumbent provider (even if its an excel spreadsheet) is your competitor!

Fundraising Goals

Apart from how much you are looking to raise and the use of funds, VCs are also interested in understanding what the company will look like (number of clients, revenue, employees, margins) towards the end of your runway.

Although all the above are necessary to include in your deck, if you only had 2 slides to show early stage investors, those would need to be Technology/ Product and Team. Everything else is fixable.

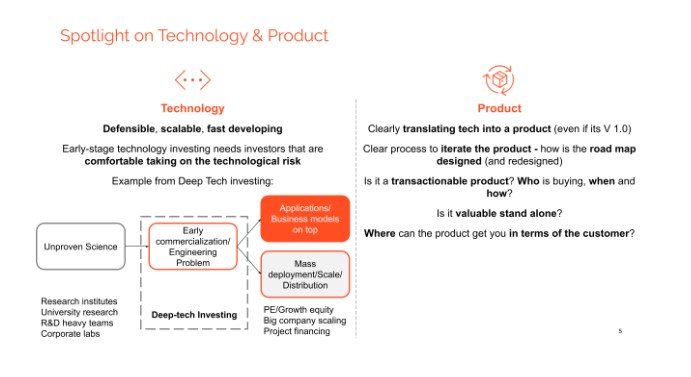

Spotlight on Technology & Product

The Product slide usually follows the solution slide. Whilst the solution slide explains the benefits to your customers of your product, the product slide explains what your product actually is and how it works.

In many cases, companies rely on advanced technology for their product. Investors will frequently spend time understanding the underlying technology and asking various questions. Deep-tech companies usually entail high technological risk and slower time-to-market, with steeper growth curves afterward. Hence, VCs experienced in these types of investments are usually more comfortable taking on these challenges together with the startup founders.

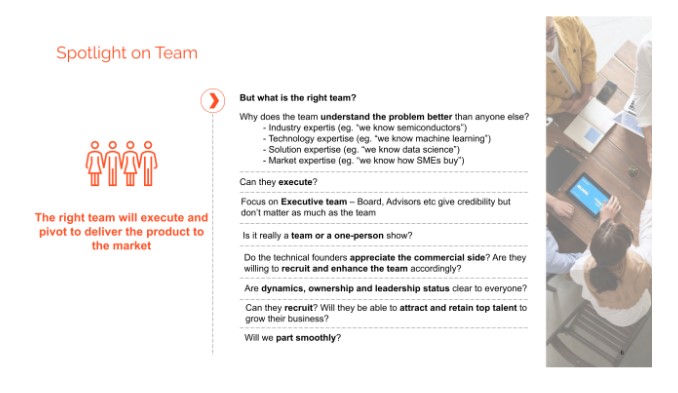

Spotlight on Team

The investors won’t finance your startup unless they believe in your team. Hence, it’s important to present your team line-up, complete with key stakeholders to the investors to gain their confidence.

Conclusion

Like any skill, fundraising takes practice. The more experience you get with it, the more natural it becomes. We hope this ultimate guide to startup funding has been helpful as you prepare for your company’s next stage of growth.

Don’t forget, at the end of the day, investors want to be part of success stories!